Higher Disposable Income To Boost Tourism: Union Minister On GST Reforms Impact

- Date & Time:

- |

- Views: 22

- |

- From: India News Bull

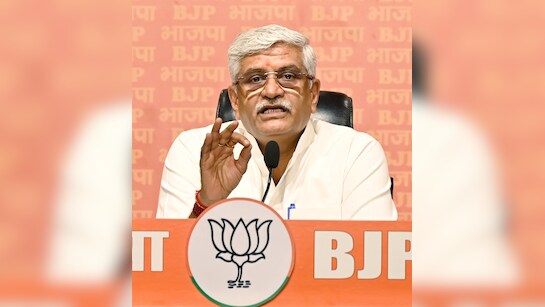

Union Culture and Tourism Minister Gajendra Singh Shekhawat highlighted that reforms in Goods and Services Tax (GST) will enhance taxpayers' savings, creating a "direct positive impact" on the tourism industry.

Speaking exclusively with NDTV, Mr. Shekhawat explained that these GST reforms will provide consumers with more disposable income. "When taxes are reduced, whether direct or indirect, people have additional savings available. This increased disposable income naturally stimulates travel, as consumers are more inclined to spend on tourism activities," the minister elaborated.

The minister expressed gratitude to travelers who contributed to India's tourism growth. "I sincerely thank the 290 million individuals who traveled last year. These GST reforms are specifically designed for them," Mr. Shekhawat stated.

Mr. Shekhawat emphasized that these reforms will particularly benefit the neo middle class, who have experienced upward mobility under Prime Minister Narendra Modi's administration. "Previously, poverty was exploited for political gain. Now, policies are crafted with the most vulnerable populations in mind. 25 crore people have risen above the poverty line. This emerging neo middle class will receive the greatest benefits," he noted.

Discussing the broader Aatmanirbhar Bharat vision, the minister encouraged citizens to embrace "Swadeshi" during the festive season. "Navratri is traditionally a shopping festival. Swadeshi represents the path to self-reliance. I urge people to support local products, advocate for them, and help elevate local offerings to global recognition," he said.

Dismissing Opposition criticism, Mr. Shekhawat criticized Congress and Trinamool Congress leaders: "I refrain from addressing Mamata (Banerjee) and Rahul (Gandhi)'s statements. They previously advocated for GST's abolishment. Now that GST has proven to be a significant economic stimulus, they're reversing their position and attempting to claim credit for these reforms," he concluded.